Valuation: Projected DCF

The Projected DCF uses the cash flows from your projection scenarios to build a Discounted Cash Flow (DCF) valuation model.

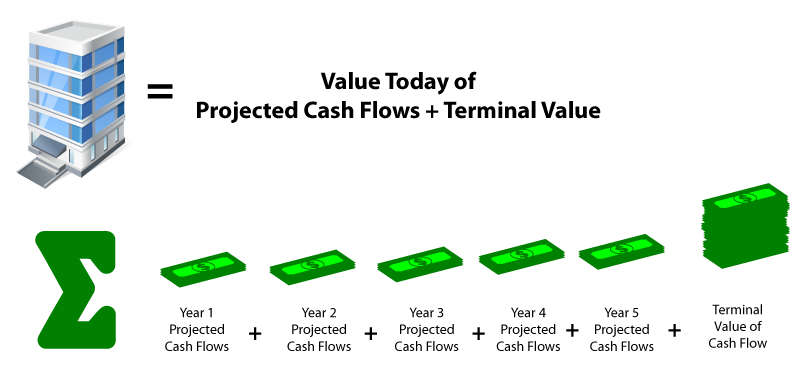

The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each projection period discounted back to present day value.

Components of DCF Model

Cash Flow (CF)

Cash Flow (CF) represents the free cash payments an investor receives in a given period for owning a given security (bonds, shares, etc.)

When building a financial model of a company, the CF is typically what’s known as unlevered free cash flow.

Discount Rate (r)

For business valuation purposes, the discount rate is typically a firm’s Weighted Average Cost of Capital. Investors use WACC because it represents the required rate of return that investors expect from investing in the company.

Period Number (n)

Each cash flow is associated with a time period.

Terminal value

When valuing a business, the forecasted cash flow typically extends about 3 - 10 years into the future, at which point a terminal value is used. The reason is that it becomes hard to make a reliable estimate of how a business will perform that far in the future.

There are two common methods of calculating the terminal value:

- Exit multiple (where the business is assumed to be sold)

- Perpetual growth (where the business is assumed to grow at a reasonable, fixed growth rate forever)

- The Provamark model uses the Exit multiple approach.