Perpetual Growth DCF

Perpetual Growth / Dividend Discount Model

Key Assumption: Owner receives all the company's cash flows (dividend)

The dividend discount model, or DDM, is a method used to value stocks that uses the theory that a stock is worth the sum of all of its future dividends. Using the stock's price, the company's cost of capital, and the value of next year's dividend, there is a formula that can help us determine the intrinsic value of the stock.

!!The dividend discount model

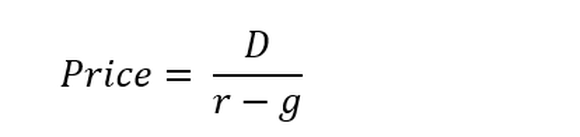

There are several dividend discount models to use, but by far the most common is known as the Gordon Growth Model, which uses next year's estimated dividend (D), the company's cost of equity capital (r), and the estimated future dividend growth rate (g).

A few notes:

- The price you're calculating is the stock's'' ''value based solely off of dividends.

- If the company has not declared a dividend for next year yet, it's safe to assume that it will grow at a rate consistent with the company's historical dividend growth. This may or may not be a safe assumption, especially if the low-interest environment persists.

- The cost of equity capital (r), can also be interpreted as the required rate of return. So, if your goal is to produce an annual rate of 10% from your investments, you should use 0.10 here. The price you calculate will be the theoretical price you should pay for the stock that will produce your required rate of return.

- For stocks with a solid history of dividend growth, it's reasonable to assume that the historical dividend growth rate will continue, unless the company has stated otherwise.